MAIA’s Ateganosine Challenges the "3L Graveyard" in Lung Cancer

In a decisive move to disrupt the stagnation of salvage therapy, MAIA Biotechnology initiates a pivotal Phase 3 trial. With a mechanism that turns 'cold' tumors 'hot' and survival data tripling the standard of care, Ateganosine is poised to be a major target for Big Pharma—if it can navigate the logistics of delivery.

- These analyses reflect my personal opinions and may include input from multiple sources. They are for informational purposes only and do not constitute professional advice. *

The Hook: Breaking the 6-Month Ceiling

In the high-stakes arena of Non-Small Cell Lung Cancer (NSCLC), the "Third-Line" (3L) setting has long been considered a clinical dead end. For the 30,000 U.S. patients annually who progress after platinum-based chemotherapy and immune checkpoint inhibitors (ICIs), options are bleak. The standard of care, Docetaxel, offers a median Overall Survival (OS) of just 5.8 months—a number that hasn't moved significantly in decades.

This week, that ceiling showed its first major crack. MAIA Biotechnology announced the initiation of a pivotal Phase 3 trial for ateganosine (THIO). Backed by Phase 2 data showing a median OS of 17.8 months, the drug promises not just an incremental improvement, but a potential tripling of life expectancy for patients with few remaining options.

The Science: A "Dual Mechanism" Disruptor

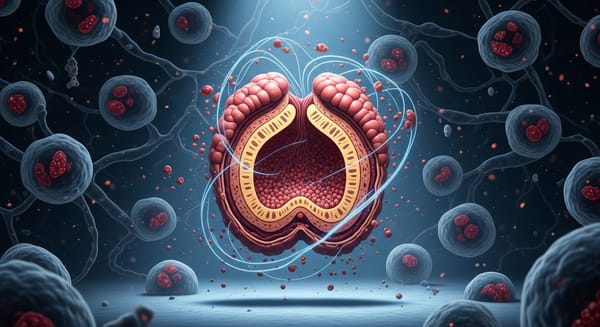

To understand why ateganosine is generating buzz in both research labs and boardrooms, one must look beyond standard cytotoxicity. Most chemotherapies kill cells indiscriminately. Ateganosine is a precision weapon targeting telomerase, an enzyme active in >85% of human cancers but largely absent in normal somatic cells.

The Mechanism of Action (MOA) involves a sophisticated two-step sequence:

- Telomere Uncapping: As a modified guanosine analog, ateganosine is incorporated into telomeres by telomerase. This disrupts the protective "cap" of the chromosome, creating Telomere dysfunction-Induced Foci (TIFs).

- Immune Ignition (Cold to Hot): This is the game-changer. The genomic instability causes the release of DNA fragments into the cytoplasm, triggering the cGAS/STING pathway. This ancient innate immune alarm system alerts the body to "viral-like" danger, effectively turning an immunologically "cold" tumor (one that hides from the immune system) into a "hot" target.

By priming the tumor microenvironment, ateganosine makes the cancer vulnerable to immune attack once again. This explains why the Phase 3 trial combines ateganosine with cemiplimab (Libtayo)—it re-sensitizes patients to the very class of drugs (ICIs) they had previously failed.

The Clinical Battleground: Efficacy vs. Friction

The clinical profile of ateganosine presents a stark contrast to the incumbent, Docetaxel.

The Efficacy Advantage:

The Phase 2 (THIO-101) data is an outlier. A Hazard Ratio target of 0.62 in the Phase 3 design signals high confidence. If the drug hits its endpoints, it renders single-agent chemotherapy obsolete on efficacy grounds alone.

The Safety Trade-Off:

Oncologists often hesitate to prescribe 3L Docetaxel due to severe neutropenia, neuropathy, and alopecia. Ateganosine spares the bone marrow and hair follicles, offering a distinct Quality of Life (QoL) win. However, it swaps one toxicity for another: Hepatotoxicity. The drug causes dose-dependent liver enzyme elevations. While reversible, this requires rigorous monitoring and establishes a "Therapeutic Window" that demands physician vigilance. It is not a "fire and forget" therapy.

The Logistic Hurdle:

Here lies the greatest friction point for commercial adoption. The ateganosine regimen involves infusions on Days 1, 2, 3, and 5 of a 21-day cycle.

- Docetaxel: 1 visit per 3 weeks.

- Ateganosine: 4 visits per 3 weeks.

In the high-volume environment of community oncology, chair time is the scarcest resource. Convincing practice administrators to schedule four visits for a single patient will require overwhelming clinical data. The survival benefit must be so undeniable that the logistical burden becomes ethically unavoidable.

The Payoff: A Target for Big Pharma?

MAIA is positioning ateganosine as the ultimate "Bolt-On" asset.

The patent cliffs for major Checkpoint Inhibitors (Keytruda, Opdivo) are looming. Pharma giants are desperate for combinations that extend the patent life and utility of their franchises. Ateganosine solves the industry's biggest biological problem: Checkpoint Resistance.

- Regeneron ($REGN): As the manufacturer of cemiplimab (used in the trial), they have a front-row seat to the data. Acquiring MAIA would give them a proprietary combination to challenge Merck's dominance in lung cancer.

- Merck ($MRK) & BMS ($BMY): Both have immense exposure to the NSCLC market and need novel mechanisms to maintain market share in the post-IO setting.

Valuation Impact:

With the Phase 3 trial now active and FDA Fast Track designation secured, the asset is significantly de-risked. The primary remaining risks are execution (enrolling the trial quickly) and capital (funding the burn). However, the potential to address a $2B+ market niche with a first-in-class agent implies a valuation disconnect that M&A activity could rapidly correct.

Final Verdict

Ateganosine represents a high-reward, moderate-risk proposition. It challenges the dogma that telomere targeting is "undruggable" and offers hope to a patient population that has been clinically abandoned. If the Phase 3 data mirrors the Phase 2 signals, we are not just looking at a new drug; we are looking at the birth of a new therapeutic category in oncology. The question is not if it works, but whether the healthcare system can adapt to deliver it.

These analyses reflect my personal opinions and may include input from multiple sources. They are for informational purposes only and do not constitute professional advice.

Copyright © 2025 ClinRM, LLC. Content is shared for non‑commercial use only. No reproduction, distribution, or reliance for commercial purposes is permitted.