Structure's Aleniglipron: Strong Data, Slower Timeline in the Oral GLP-1 Race

Phase 2b results confirm high efficacy and safety, but the pivot to a slower titration protocol pushes Phase 3 to mid-2026, widening the gap with lead competitors.

- These analyses reflect my personal opinions and may include input from multiple sources. They are for informational purposes only and do not constitute professional advice. *

Clinical Executive Summary

Structure Therapeutics (NASDAQ: GPCR) has reported positive topline data from the Phase 2b ACCESS program for Aleniglipron (GSBR-1290), an oral small molecule GLP-1 receptor agonist. The data suggests a highly competitive efficacy profile for an oral agent, paired with a distinctively clean safety profile regarding hepatic and cardiac parameters.

Key Efficacy Findings

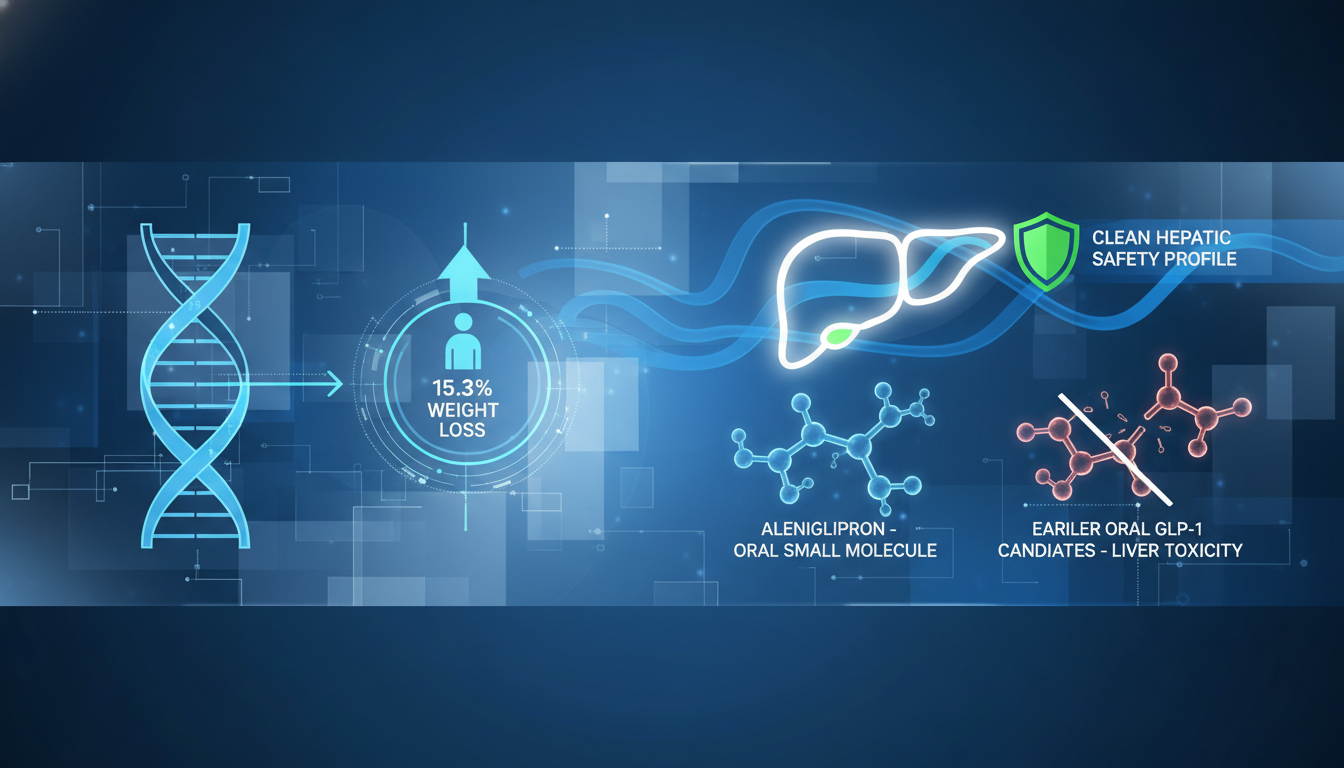

In the core Phase 2b ACCESS study (N=230), the 120 mg dose achieved a placebo-adjusted mean weight loss of 11.3% at 36 weeks (p<0.0001). Furthermore, the exploratory ACCESS II study, evaluating higher titration targets, demonstrated a placebo-adjusted mean weight loss of up to 15.3% with the 240 mg dose at 36 weeks.

Critically, the weight loss curves showed no evidence of a plateau at week 36, suggesting further efficacy potential in longer-duration studies.

Safety and Tolerability: Solving the Oral Challenge

Historically, oral small molecule GLP-1s have struggled with liver toxicity signals. Aleniglipron showed:

- No drug-induced liver injury (DILI).

- No persistent liver enzyme elevations.

- No QTc prolongation.

While the adverse event (AE) discontinuation rate was 10.4% in the core study (driven by nausea/vomiting), sub-study data utilizing a slower 2.5 mg starting dose resulted in zero AE-related discontinuations during the titration phase. This optimized dosing regimen will be pivotal for the Phase 3 program.

Mechanism of Action

Aleniglipron utilizes biased GPCR agonism, selectively activating G-protein signaling while minimizing beta-arrestin recruitment. This mechanism is hypothesized to prevent receptor downregulation, potentially offering sustained efficacy and a wider therapeutic window compared to unbiased agonists.

Clinical Outlook

The company plans to initiate Phase 3 in mid-2026. If the safety profile holds, Aleniglipron represents a scalable, accessible oral option that could serve as a backbone for combination therapies in metabolic management.

Strategic Analysis: Balancing Efficacy and Speed

Structure Therapeutics (NASDAQ: GPCR) has cemented Aleniglipron as a legitimate contender in the high-stakes race for oral obesity treatments. The Phase 2b ACCESS data reveals a candidate that offers biologic-like efficacy (up to 15.3% weight loss) with the manufacturing scalability of a small molecule.

The Clinical Win

The differentiation here is safety. In a class plagued by liver toxicity concerns, Aleniglipron's clean hepatic profile is a significant competitive moat. Furthermore, the biased GPCR agonist mechanism appears to deliver sustained weight loss without a plateau at 36 weeks.

The Strategic Trade-off

However, the data revealed a tolerability hurdle: a 10.4% discontinuation rate in the core study. Structure's solution—a slower titration starting at 2.5 mg—appears effective (reducing early dropouts to 0% in sub-studies), but this necessitates a more complex dosing regimen and has likely contributed to the timeline guidance.

With Phase 3 not starting until mid-2026, Structure is conceding time to Eli Lilly's orforglipron (already in Phase 3).

Commercial Implications

Structure is betting that a "slow and steady" approach yields a commercially superior product: one with a better safety profile and higher long-term adherence, even if it arrives to market later. This positions Aleniglipron not just as a competitor, but as an ideal "backbone" therapy for future oral combinations (e.g., with amylin or GIP agonists), potentially making it an attractive licensing or acquisition target for majors looking to leapfrog current generation injectables.

Investment Thesis: The Scarcity Premium

Structure Therapeutics (NASDAQ: GPCR) has delivered exactly what the market needed to see: competitive efficacy combined with a pristine safety profile. In the race for the "Holy Grail" of metabolic disease—a scalable oral small molecule—Aleniglipron has validated its potential as a blockbuster asset.

The Numbers that Matter

- Efficacy Ceiling: The 15.3% placebo-adjusted weight loss (240 mg) at 36 weeks is highly competitive against Eli Lilly's ($LLY) orforglipron. The lack of a plateau suggests final efficacy could track even higher.

- De-Risking Safety: The absence of liver toxicity (DILI) and cardiac signals removes the biggest bearish thesis on small molecule GLP-1s (recall Pfizer's lotiglipron discontinuation).

- Fixing the Dropouts: The 10.4% discontinuation rate was a concern, but the data on the 2.5 mg starting dose (0% discontinuations) provides a clear clinical path to improved retention in Phase 3.

M&A Implication: The Window is Open

With Roche acquiring Carmot and AstraZeneca licensing Eccogene's asset, Structure is one of the last high-quality, unencumbered oral GLP-1 plays. Big Pharma (specifically Pfizer, Sanofi, and Merck) are actively seeking entry into the obesity market but lack advanced oral assets. Structure's cash runway extends to 2027, giving them leverage, but the initiation of an expensive Phase 3 program in mid-2026 makes a near-term exit logical.

Valuation Impact

Today's data confirms $GPCR holds a potentially best-in-class asset. The mid-2026 Phase 3 start is slightly later than some aggressive estimates, but the quality of the data justifies the timeline.

M&A LIKELIHOOD: High

Rationale: Scarcity value of unencumbered oral GLP-1 assets.

Strategic Fit: High. Offers scalable manufacturing vs. peptide constraints.

Top Suitors:

- $PFE (Pfizer): Desperate to fill the hole left by lotiglipron/danuglipron struggles.

- $SNY (Sanofi): Needs a metabolic reentry strategy.

- $MRK (Merck): Seeking diversification beyond oncology ($MRK).

These analyses reflect my personal opinions and may include input from multiple sources. They are for informational purposes only and do not constitute professional advice.

Copyright © 2025 ClinRM, LLC. Content is shared for non‑commercial use only. No reproduction, distribution, or reliance for commercial purposes is permitted.