Relay's Zovegalisib Challenges Standard of Care by Decoupling Efficacy from Toxicity

In a crowded HR+/HER2- landscape, Relay Therapeutics has potentially delivered the 'Holy Grail' of PI3K inhibition—demonstrating robust PFS benefits without the metabolic penalties that have plagued the asset class for a decade.

- These analyses reflect my personal opinions and may include input from multiple sources. They are for informational purposes only and do not constitute professional advice. *

The Hook: A New Chapter in Precision Oncology

For years, the treatment of HR+/HER2- breast cancer has been a story of incremental gains shadowed by substantial toxicity. While the discovery that PIK3CA mutations drive resistance in nearly 40% of these cancers opened a new therapeutic door, walking through it has been painful for patients. First-generation inhibitors, while effective, levied a heavy tax on the body: severe hyperglycemia, debilitating rash, and gastrointestinal distress caused by off-target inhibition of the wild-type enzyme.

Today, that narrative shifts. Relay Therapeutics has unveiled data from its ReDiscover trial (Phase 1b/2) for Zovegalisib (RLY-2608) that suggests the industry has finally cracked the code. By leveraging computational motion-based drug design, Relay has engineered a molecule that hits the mutant target while ghosting the wild-type enzyme. The result? A potential best-in-class therapy that offers the efficacy oncologists demand with the safety profile patients deserve.

The Science: Decoupling Toxicity from Efficacy

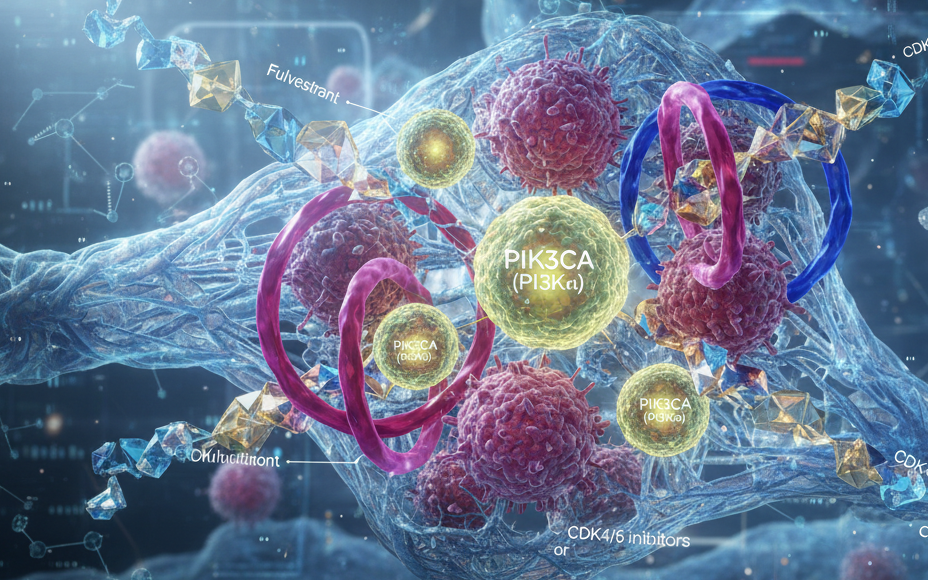

To understand the magnitude of this data, one must understand the failure of the predecessors. Drugs like alpelisib function as orthosteric inhibitors—they bind to the active site of the enzyme. The problem is that the active site of the mutant PI3Kα and the healthy wild-type PI3Kα are strikingly similar. It is a blunt instrument approach.

Zovegalisib is different. It is an allosteric inhibitor. It binds to a non-active site, locking the enzyme in a conformation that prevents signaling. Crucially, this binding mode is highly selective for the mutant forms (H1047X, E542K, E545K) found in tumors, while leaving the wild-type enzyme—which regulates insulin and glucose metabolism—largely untouched.

The ReDiscover data validates this mechanism with striking clarity:

- Efficacy: In the pivotal efficacy subset (N=52 evaluable), Zovegalisib + Fulvestrant delivered a confirmed Objective Response Rate (ORR) of 38.7%.

- Durability: The Median Progression-Free Survival (mPFS) was 10.3 months across all lines, and notably 11.4 months in the Second-Line (2L) setting.

- Pharmacodynamics: The study showed rapid, deep, and sustained reductions in PIK3CA mutant allele frequency in ctDNA, confirming potent target engagement.

This efficacy is not just statistically significant; it is clinically meaningful, placing Zovegalisib squarely in competition with, and potentially ahead of, existing standards.

The Battleground: Eclipsing the "Alpelisib Shadow"

The true differentiator, however, is not just how well the drug works, but how well patients live while taking it. The shadow hanging over PI3K inhibitors has always been safety. In the ReDiscover trial, Zovegalisib demonstrated a safety profile that looks radically different from historical controls:

- No Grade 4 or 5 Treatment-Related Adverse Events (TRAEs).

- Median Relative Dose Intensity: 90%. This is a critical metric. It means patients are taking the drug as prescribed, rather than skipping doses to manage side effects.

- Metabolic Stability: Hyperglycemia, the scourge of the class, was low-grade and manageable.

By comparison, pivotal trials for non-selective inhibitors often show high rates of discontinuation due to adverse events. Zovegalisib’s ability to maintain high dose intensity directly contributes to its efficacy—a drug only works if the patient takes it.

The Commercial Path Forward: A Billion-Dollar Moat?

Strategically, Relay Therapeutics has positioned Zovegalisib to dominate the post-CDK4/6i setting. The competitive landscape is dense, populated by AKT inhibitors like capivasertib, oral SERDs, and emerging ADCs. However, Zovegalisib holds a unique advantage.

AKT inhibitors, while effective, come with their own toxicity baggage and act downstream. By intercepting the signal upstream at PI3Kα—without the toxicity—Zovegalisib offers a more precise intervention. Furthermore, the data showed efficacy regardless of ESR1 mutation status or prior SERD use. This "agnostic" efficacy makes Zovegalisib an ideal partner for endocrine therapies, potentially becoming the backbone of 2L treatment for the 40% of patients with PIK3CA mutations.

This creates a massive commercial moat. If Phase 3 data replicates these safety findings, it will be difficult for oncologists to justify prescribing a non-selective inhibitor with a harsh side-effect profile when a mutant-selective option exists.

A Target for Big Pharma? (M&A Analysis)

The release of this data significantly elevates Relay’s profile as an acquisition target. The logic is threefold:

- Pipeline Gaps: Major players like Pfizer are staring down the barrel of patent cliffs. With Ibrance facing loss of exclusivity later this decade, Pfizer needs a de-risked asset to maintain its dominance in HR+ breast cancer. Zovegalisib fits this profile perfectly.

- Franchise Protection: Novartis, the maker of Piqray (alpelisib), is acutely aware of the drug's limitations. Acquiring a best-in-class successor would allow them to cannibalize their own product rather than losing market share to a competitor.

- Platform Validation: Buying Relay isn't just buying Zovegalisib; it's buying the Dynamo™ platform. This data proves that Relay's motion-based drug discovery isn't just academic theory—it produces superior clinical candidates.

With a "High" acquisition likelihood score (7.8/10), the question may not be if Relay gets bought, but when.

The Final Verdict: Aggressive Progression Warranted

The ReDiscover subset analysis is a watershed moment for Relay Therapeutics. It transitions the company from a platform-based biotech to a late-stage clinical contender with a potentially transformative asset.

Critical Risks Remain: The sample size (N=64 safety) is still relatively small. Rare adverse events often only surface in larger populations. The execution of the global, randomized Phase 3 ReDisc trial will be the ultimate test. Regulatory agencies will demand clear superiority over the control arm, not just in safety, but in efficacy.

However, the signal is clear. Zovegalisib has demonstrated proof-of-concept for mutant-selective PI3K inhibition. It challenges the dogma that toxicity is the price of potency. For patients waiting for better options, and investors looking for the next breakout oncology asset, Zovegalisib is the drug to watch.

These analyses reflect my personal opinions and may include input from multiple sources. They are for informational purposes only and do not constitute professional advice.

Copyright © 2025 ClinRM, LLC. Content is shared for non‑commercial use only. No reproduction, distribution, or reliance for commercial purposes is permitted.