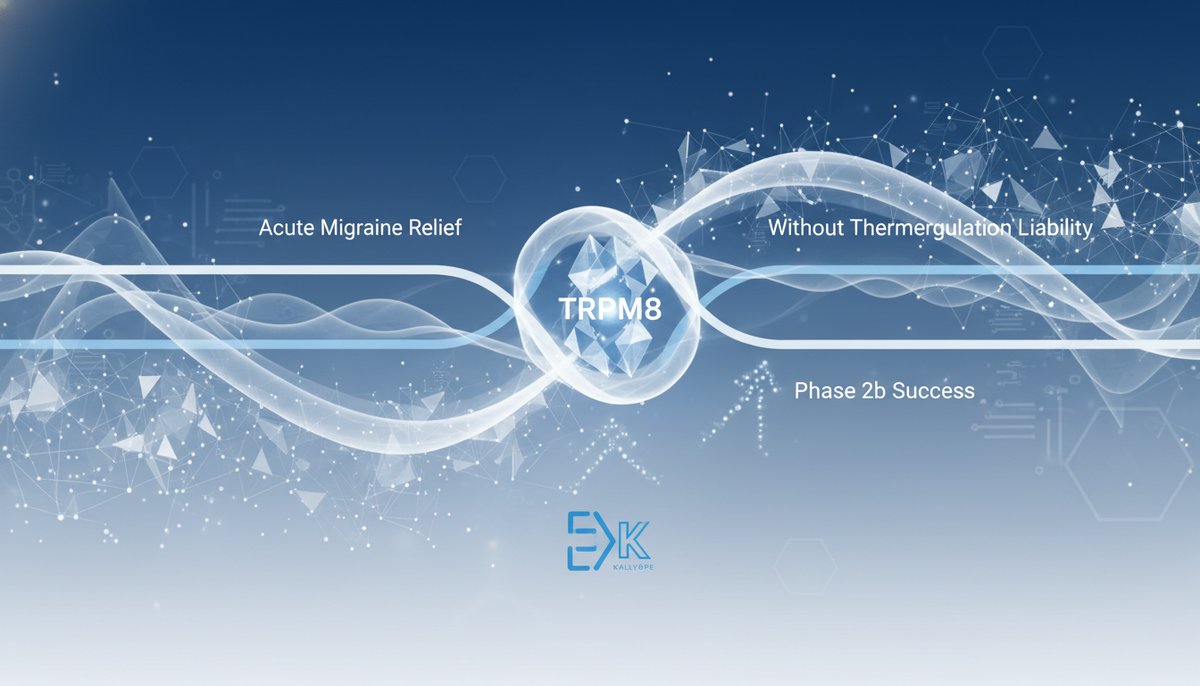

TRPM8 Validation: Elismetrep Shows Promise in Phase 2b for Acute Migraine Without Thermoregulation Liability

Kallyope's first-in-class oral antagonist meets co-primary endpoints, offering a distinct non-CGRP mechanism for refractory patients.

- These analyses reflect my personal opinions and may include input from multiple sources. They are for informational purposes only and do not constitute professional advice. *

Clinical Impact Analysis

The landscape of acute migraine treatment has long been dominated by triptans and, more recently, CGRP antagonists. However, significant unmet need remains for the ~30% of patients who do not achieve adequate relief with current standard-of-care (SOC) therapies. Kallyope’s announcement regarding Elismetrep (MT-8554), an oral TRPM8 antagonist, marks a pivotal development in diversifying the therapeutic arsenal.

The TRPM8 Mechanism

Unlike CGRP antagonists which target vasodilation and pain transmission pathways associated with the calcitonin gene-related peptide, Elismetrep targets Transient Receptor Potential Melastatin 8 (TRPM8). This ion channel is expressed on trigeminal sensory neurons distinct from those targeted by current therapies. The Phase 2b data (n=431) successfully met regulatory endpoints for pain freedom and freedom from most bothersome symptoms (MBS) at 2 hours.

Safety Profile: Clearing the Hypothermia Hurdle

Historically, the TRPM8 class issues included potential on-target effects related to thermoregulation (hypothermia). Crucially, Elismetrep demonstrated a favorable safety profile with no safety signals, notably there none realted core body temperature reduction. This suggests Kallyope may have successfully decoupled the therapeutic analgesic effect from the thermoregulatory liability.

Clinical Positioning

With Phase 3 registrational trials slated for mid-2026, Elismetrep appears positioned not just as a competitor, but potentially as a vital option for 'switchers'—patients cycling through triptans and gepants without success. Its distinct MOA also raises the interesting possibility of combination therapy, though monotherapy remains the primary development focus.

Strategic Analysis

Kallyope’s announcement of positive Phase 2b results for Elismetrep represents a significant milestone for the company's platform, validating its Gut-Brain Axis discovery engine even as it pivots toward pure neurology.

The Good: Scientific Execution

The data package appears robust where it counts. By meeting efficacy endpoints while avoiding thermoregulatory safety signals, Kallyope has succeeded where others failed with TRPM8 antagonists. This opens the door to a truly novel class of therapeutics for migraine sufferers who have exhausted triptans and CGRPs.

The Challenge: Commercial Reality

Despite the scientific win, the commercial road ahead is steep. The migraine market is dense with effective generic and branded options. When Elismetrep likely reaches the market (c. 2028-2029), it will face entrenched competition from heavyweights like Pfizer ($PFE) and AbbVie ($ABBV).

The Outlook

Success will depend on positioning. Elismetrep cannot merely be "as good as" current therapies; it must prove utility in the distinct sub-population of non-responders. With Phase 3 starting in mid-2026, Kallyope has time to refine this positioning, but the pressure is on to execute perfectly in a high-stakes registrational program.

Investment Thesis: Disruption in the Migraine Market

Kallyope has successfully navigated a major binary risk event with Elismetrep. By meeting primary endpoints in Phase 2b and, more importantly, avoiding the class-wide toxicity of hypothermia, the asset moves from 'speculative biology' to 'commercial viability.'

Market Dynamics & Differentiation

The acute migraine market is currently a battleground for oral CGRP antagonists (e.g., Pfizer's Nurtec ODT, AbbVie's Ubrelvy/Qulipta). While commercially successful, these drugs leave a significant white space: approximately 70% of patients report suboptimal outcomes or switch therapies. Elismetrep’s TRPM8 mechanism offers a non-overlapping biological target. This is not just "another migraine pill"; it is a pipeline-in-a-product for the refractory segment.

Valuation Implications

- Derisking: The safety data removes the primary overhang for TRPM8 assets.

- Timeline: Phase 3 initiation in Mid-2026 places potential NDA filing in the 2028 window.

- Concentration Risk: Following the pivot from obesity, Kallyope's valuation is heavily weighted on Elismetrep. This win was essential to justify capital expenditure for the upcoming registrational trials.

Competitive Landscape

While $PFE and $ABBV dominate, the genericization of triptans creates price pressure. Elismetrep must demonstrate superior efficacy or specific utility in non-responders to command premium pricing. The lack of released p-values requires caution, but the strategic setup suggests Kallyope is prepping this asset for a major partnership or exit.

Competitive Intensity Visualization

- High: Oral CGRP Antagonists (Pfizer, AbbVie)

- Medium: Elismetrep (First-in-Class TRPM8)

- Low: Generic Triptans (Price Leaders)

M&A Suitability Score: HIGH. Big Pharma neurology desks ($BMY, $JNJ, $LLY) looking to diversify beyond CGRP/Amyloid will view a clean Phase 2b TRPM8 asset as a prime licensing target.

These analyses reflect my personal opinions and may include input from multiple sources. They are for informational purposes only and do not constitute professional advice.

Copyright © 2025 ClinRM, LLC. Content is shared for non‑commercial use only. No reproduction, distribution, or reliance for commercial purposes is permitted.